Happy Friday folks.

This week we’re sharing insights into the state of the current software M&A market as well as Robert Smith’s current take on the opportunities that lie within the private tech sector.

If you are a new reader, welcome 👋 to The Weekly Bloom. Every Friday, we share our favorite SaaS articles, podcasts, tweets, and news headlines from across the industry to now ~4,500 readers.

If you've been enjoying these newsletters, would you mind sharing with a fellow enterprise software entrepreneur, investor or capital allocator that you feel would enjoy them too?

Let’s get into it 🔥

Q4: State of the software M&A Market

As Q4 is nearing an end, our team wanted to highlight some key takeaways on the current state of the SaaS M&A market.

Takeaway: Deal opportunities are not as abundant as in recent years but they do still exist

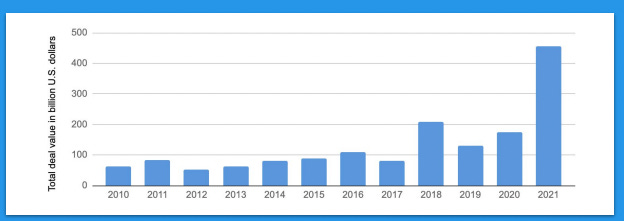

The software M&A market is experiencing a decline in activity compared to the record-breaking performance of 2020 and 2021. The total value of deal-making is expected to hit $4.7 trillion in 2022, a 20% decrease from the previous year. In addition, public company valuations have dropped below the high multiples seen in 2021. These shifts in the market are being attributed to the economic slowdown, which is characterized by inflation and rising interest rates.

Takeaway: There are still deals to be done

The software M&A market experienced record-breaking activity in 2020 and 2021, with the value of deals reaching $5.9 trillion by the end of 2021. This was due to the accelerated adoption of SaaS solutions during the pandemic, which facilitated new ways of doing business and drove high valuations in the market.

Despite the recent economic downturn, there are still opportunities for sellers in the market, as buyers are looking to make strategic acquisitions and there’s still an incredible amount of dry powder looking to be deployed.

Takeaway: Plenty of opportunities within the low-mid market

The low-to-mid market has also been relatively stable during economic disruptions. This segment of the market is likely to continue to experience lower volatility, and deals in this range are expected to be more common. Buyers are aware that their window to find and secure strategic deals may be limited and are moving quickly to take advantage of current market conditions.

Overall, the software M&A market is not expected to reach the same levels it did in 2021. However, there are still opportunities for sellers who are willing to adjust their expectations and take advantage of the current market conditions.

At Bloom Equity Partners We are actively seeking investment opportunities that fall within the following criteria:

B2B SaaS generating $2m to $20m+ in ARR

90%+ annual retention rate

A mature and proven product

Highly talented management team

We welcome the opportunity to discuss potential investments with founders, operating executives, and intermediaries.

Robert Smith: Opportunities await investors in the tech sector

Robert Smith, chairman, and CEO of Vista Equity Partners shared his thoughts on the tech sector in a CNBC Op-ed this past week.

TLDR; Enterprise software is set to continue as one of the best uses of capital in the financial and technology markets. The current environment will likely continue to create opportunities, the same way past dislocations have done. As businesses face commodity and wage inflation, they recognize the value that enterprise software can deliver to help manage the cost of day-to-day workflows while increasing efficiency. As a result, it is expected that software will continue to be the fastest-growing sector in the economy with a market capitalization of $34tn by 2025.

Check out the full Op-ed: here

What We’re Reading and Listening To…

📚 Weekly Update: Handling the Headwinds in SaaS & Keeping an Eye on AI

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

News from the Industry: deals, deals, and more deals 💰

Thoma Bravo raises largest tech-focused software fund at $24.3 bln

Vista Equity Partners Is Exploring a Deal for Coupa Software

Cinven and Ontario Teachers’ to invest in the combination of group.ONE and dogado group

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

About Bloom Equity Partners

Bloom Equity Partners unlocks growth in lower-middle market enterprise software & tech-enabled services companies through control investments and further developing already-great businesses into market leaders.

Led by a team of tech-focused investors and industry operators, Bloom injects the capital, operational resources and playbooks in recession resistant businesses to rapidly unlock transformational growth and deliver superior risk-adjusted returns to our investment partners and management teams.

If you or someone you know is considering selling or taking investment, we might be able to help out. Just reply to this thread and we can get acquainted!