The surge of PE acquisitions in venture-backed SaaS

News, insights and updates from the team at Bloom Equity Partners

Founders & Friends, Happy Friday!

We are back with another week of SaaS insights, news, and updates from the team at Bloom Equity Partners.

Favour to ask: if you've been enjoying these newsletters, would you mind sharing with a fellow SaaS entrepreneur, investor or capital allocator that you feel would enjoy them too?

Let’s get into it 🔥

The surge of VC to PE acquisitions

Since launching Bloom Equity Partners, we’ve constantly shared our conviction on the growing presence of PE becoming a growing buyer of VC-backed software businesses. It was great to see fellow investor, Tomasz Tunguz (@redpoint) share the same conviction in his latest newsletter ‘PE in VC in 22’.

Here are a few noteworthy points from the piece.

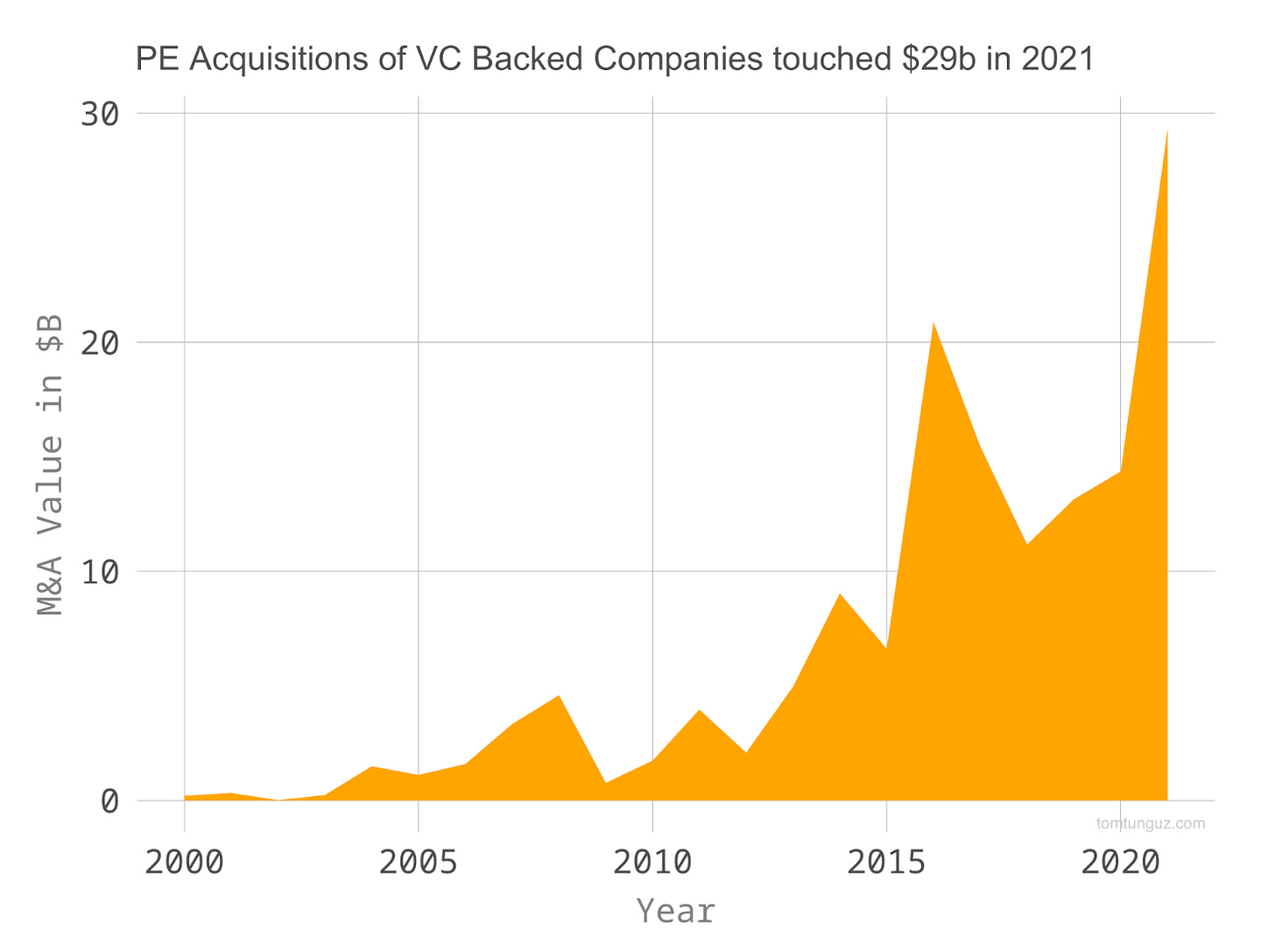

Private equity firms acquired $29 billion dollars’ worth of startups - a twenty-year record.

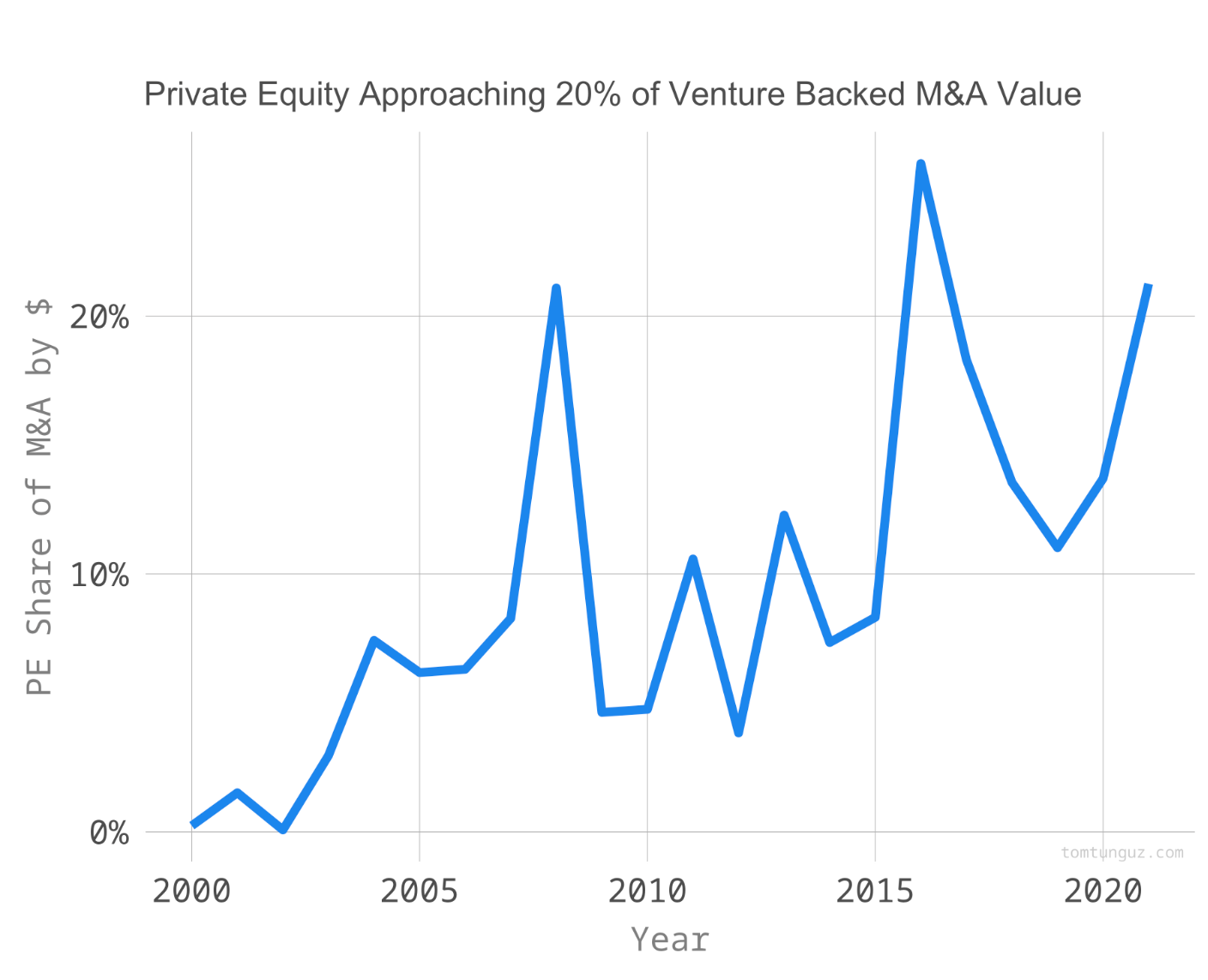

In 2021, PE buyouts constituted more than 20% of venture-backed M&A by dollars.

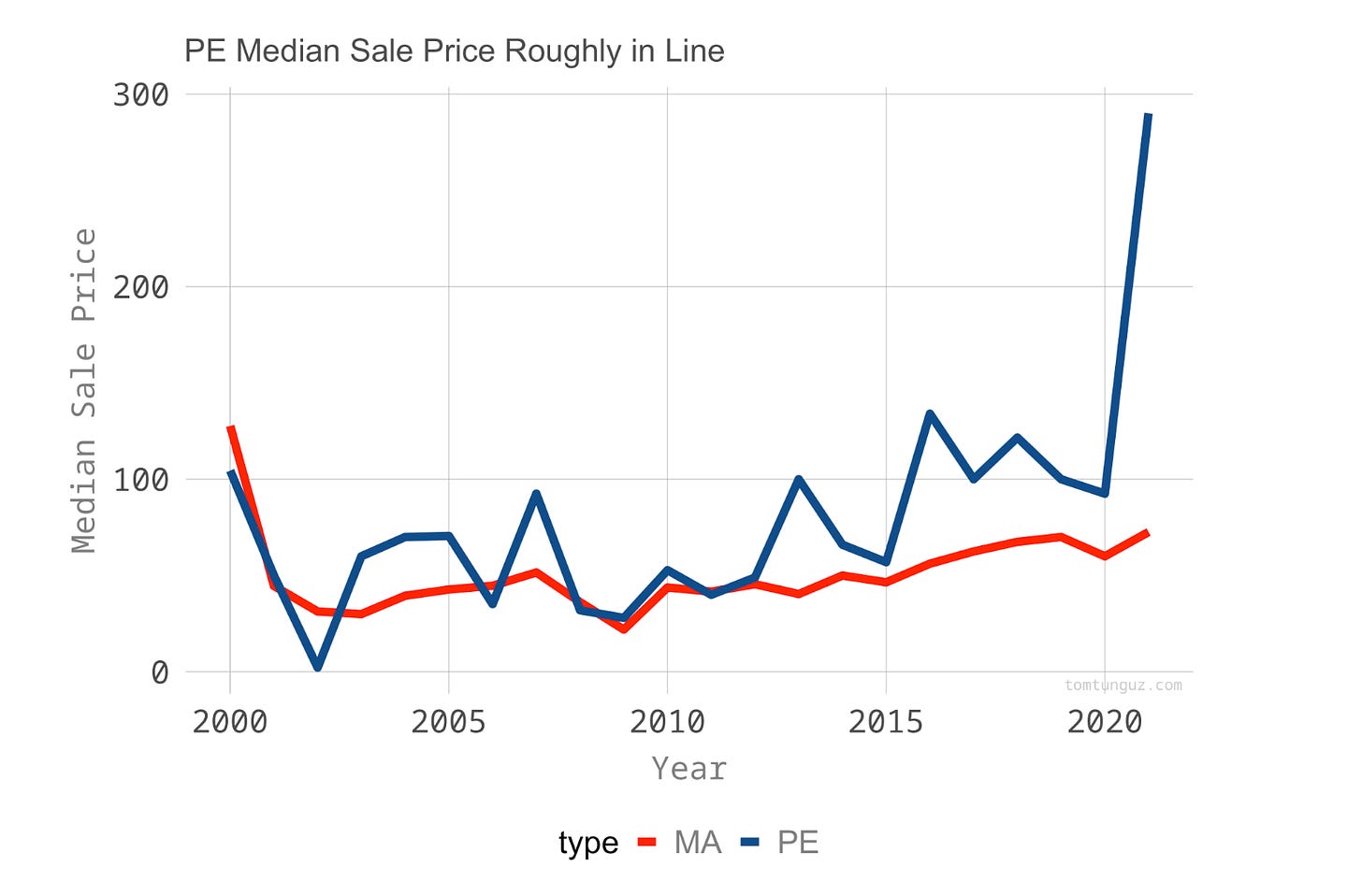

Startups bought by PE funds - record median sales prices consistent with strategic M&A.

Our take:

“PE will increasingly become a sound exit ramp for troves of great venture-backed businesses who will continue thriving under PE-style mandate and growth goals/timelines."

- Bart Macdonald, Managing Partner @Bloom Equity Partners

What We’re Reading and Listening To…

📚 Ten lessons from a decade of vertical SaaS investing

📚 The 5 SaaS Metrics That Actually Matter

Favorites from the Ecosystem

Investors👇…..

Founders👇…..

Operators👇….

News from the Industry: deals, deals, and more deals 💰

PointClickCare valuation tops US$5-billion as private equity invests more in Canadian software giant

PE eyes discounts on software-as-a-service companies

Carlyle to Sell Unison Software to Buyout Firm Madison Dearborn

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.