Today's SaaS Landscape: Efficient Growth

News, insights and updates from the team at Bloom Equity Partners

Happy Friday technology investors, operators, and enthusiasts.

We’re here again with The Bi-Weekly Bloom – one of the best resources for Private Equity, Enterprise Software, and Technology news.

PE Interest in Technology

Our team’s favorite articles and podcasts from last week

Insightful tweets from fellow investors and operators

Join over 7,000 readers for a summary our favorite software insights, articles, podcasts, tweets, and news headlines, subscribe below:

Today’s SaaS Landscape: Efficient Growth

In today’s challenging economic climate, SaaS leaders face a difficult decision in today’s economic climate: improving growth or efficiency.

To help SaaS businesses decide on the next steps, ICONIQ released its latest report on what growth and efficiency look like across the enterprise SaaS landscape, The New Era of Efficient Growth: Topline Growth and Operational Efficiency. The report analyzes quarterly operating and financial data from 96 B2B SaaS companies to help these businesses understand how to scale quickly and efficiently and explore early indicators and drivers of long-term success. The results recommend a tandem solution — efficient growth.

The companies in the report represent a mix of sectors and business models that highly represent the overall B2B SaaS market.

Here are a few relevant highlights from the report:

Today’s SaaS Landscape

Impact to Topline

2023 has seen continued deterioration in topline performance as the macro environment remains challenging for SaaS businesses. While topline growth has fallen across the board, early-stage companies saw the biggest impact on ARR growth, falling from peak levels of 200%+ YoY growth to 111% YoY as of 1H 2023. Net dollar retention has been similarly impacted, falling from peak levels of 120-130% in 2017 to ~105% as of 1H 2023, driven by both elevated levels of churn and weakened expansion.

The Era of Efficient Growth

As growth has slowed, companies have focused on reducing spending and extending the runway via levers such as hiring freezes, reductions in force (RIFs), tool rationalization, and performance management. Sales efficiency has declined as selling SaaS tools and platforms has become more challenging in the macro environment. This can be seen in the decrease in net magic number, falling from peak multiples of 1.7x to <1.0x in 1H 2023.

The Trade-off between Growth vs. Efficiency

Enterprise Five

ICONIQ identified five key metrics highly representative of a B2B SaaS company’s overall growth and efficiency.

What’s Changed From 2022

The report covers some key growth and efficiency metrics that have changed (or remained consistent) over the last year.

The Pace of Growth: The economic climate in 2022 and 2023 has significantly impacted SaaS performance, with median and top quartile benchmarks for growth and retention metrics dropping significantly.

Growth Drivers: In 2022, expansion only became a primary driver of growth ARR after companies reached $200M ARR. Now, companies prioritize expansion earlier in the company lifecycle, with expansion exceeding 50% of gross new ARR as early as the $100M ARR range. In addition to focusing on existing customers, many SaaS companies are exploring channel and partnership strategies to accelerate growth.

Spend and Burn: A renewed focus on efficiency and a path to profitability has moved the needle on both gross and FCF margins; however, the pace and scale of spend reductions do not match the speed at which growth slowed, leading to efficiency metrics like Rule of 40 and magic number dropping across the board. Average spend per FTE also increased since last year’s report, likely driven by inflationary pressure. However, cost allocation across G&A, S&M, and R&D remained consistent with prior years, with S&M continuing to make up ~50% of total spend.

GTM Efficiency: Budget constraints, increased scrutiny on purchasing discretionary software tools, and tool rationalization/consolidation are among the many factors that have made selling SaaS harder, impacting GTM efficiency and customer health. This has resulted in declines to the magic number and expected customer lifetime and increased payback periods for customer acquisition.

Four Predictions for 2024 (and Beyond)

The rise of usage-based pricing: Usage-based pricing (UBP) will be more prevalent, especially as SaaS products focus on driving efficiency for organizations and pricing based on value rather than seats. However, as UBP is inherently volatile, significant fluctuations may occur with much higher ranges in net dollar retention in parallel with market changes. Growth rate decreases as companies scale; Enterprise SaaS companies with top performance in ARR growth that utilize usage-based pricing models experience ~200% YoY growth

Expansion becomes the primary driver of growth: With more companies powered by product-led growth (PLG) or leveraging bottom-up sales, expansion will become a larger and more significant portion of new ARR. New logos are the primary driver of ARR growth until companies reach ~$100M ARR, at which point expansion starts to contribute more than 50% of gross new ARR.

The Rule of 60: The Rule of 40 may soon become the Rule of 60 with the introduction of AI, bringing about significant operational efficiencies to organizations and the potential to unlock new growth vectors. Rule of 40 tends to decline as SaaS companies scale and growth slows. However, top-quartile companies can achieve the Rule of 40 regardless of the ARR scale

Profitability before IPO: Best-in-class companies will hit profitability sooner (within six to seven years after reaching $10M ARR or three to four years after reaching $100M ARR) before going public, rather than the precedent of most SaaS companies being un-profitable at IPO.

Resiliency Rubric

In times of volatility, we recognize that the Enterprise Five is not a comprehensive health framework for companies that need to move quickly and understand which business levers to prioritize.

You can view the full report here.

About Bloom Equity Partners

We're big fans of mission-critical enterprise software, technology and tech-enabled business service companies with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure. We are actively seeking investment opportunities that fall within the criteria below. We welcome the opportunity to discuss potential investments with founders, operating executives and intermediaries.

Our Investment Criteria

Industry: Enterprise Software, Technology and Tech-Enabled Business Services

Geography: North America, Europe, Australia and New Zealand

Revenue: $5M - $50M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% gross annual customer retention

Profitability: Positive EBITDA or near breakeven within twelve months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment in their business, we would love to learn more! We just launched our referral partner program, which compensates referrers for introductions that lead to affirmative outcomes.

What We’re Reading and Listening To…

New SaaS Employment Index: New research series tracking headcount across 3,500+ US-headquartered, private software companies.

God Bless Klavyio: the first pure-play SaaS IPO in ~2 years!

Favorites from the Ecosystem

Investors…

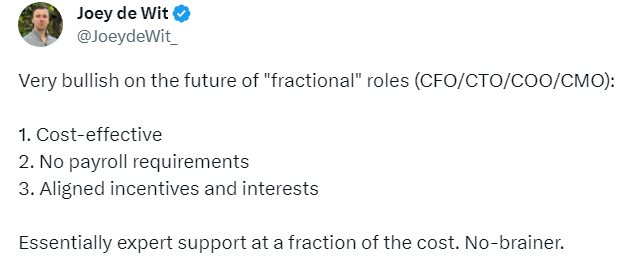

Operators…

Founders…

If you're enjoying The Bi-Weekly Bloom, we'd appreciate it if you shared it with your network.

Thanks for including our SaaS Employment Index AND our podcast.

For non-Apple Podcast users, links to the "Cloud Cost Optimization" episode are here:

https://cloudradio.cloudratings.com/episodes/ben-schaechter-from-vantage-cloud-cost-optimization-explained