Will we see an uptick of take-private deals in 2023?

News, insights and updates from the team at Bloom Equity Partners

Happy Friday folks.

We’re back with The Weekly Bloom - a must-read for investors, operators, and founders navigating the world of software private equity.

2022 is coming to an end, and this will be the final Weekly Bloom of the year. We would like to thank all of our readers for their support and engagement. We have exciting plans and announcements for Bloom Equity Partners in 2023, so subscribe and stay tuned for updates!

If you’re a new reader and not familiar with Bloom Equity Partners, here’s a quick 1-min intro 👇👇

About Bloom Equity Partners 🚀

Bloom Equity Partners unlocks growth in lower-middle market enterprise software & tech-enabled services companies through control investments and further developing already-great businesses into market leaders.

Led by a team of tech-focused investors and industry operators, Bloom injects the capital, operational resources, and playbooks in recession-resistant businesses to rapidly unlock transformational growth and deliver superior risk-adjusted returns to our investment partners and management teams.

If you or someone you know is considering selling or taking investment, we might be able to help out. Just reply to this thread and we can get acquainted!

2023 Private Equity Predictions

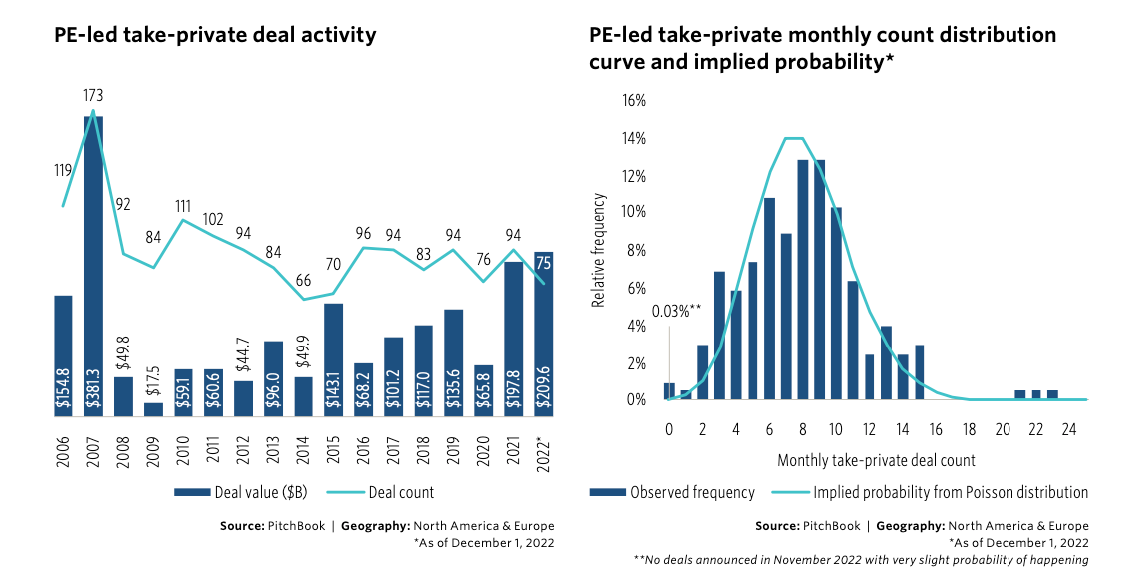

Is deal fatigue setting in on larger PE deals? Given the same macro headwinds that have faced PE deal activity across the board in 2022, mega buyouts have become increasingly more difficult to finance with debt capital. This can be seen can see in recent trends affecting take-privates, which tend to be the largest buyout deals in any given year.

According to a recent pitchbook report, November was the second month since 2006 to not have a single take-private deal announced. This was quickly shadowed by the Thoma bravo $8 Billion acquisition of Coupa software, earlier this month. So what does this mean for the future of take-private deals in 2023?

It appears unlikely that take-private transactions will slow down any time soon. The logic still makes sense for buyers to scoop up attractive public companies at significant discounts while private market valuations are often lagging public comps.

Of the 75 public-to-private acquisitions announced this year, PE firms paid an average discount of 6.7% to the target’s 52-week share price high. This was no small doing given that these stocks typically rose by 20% to 30% from their unaffected share prices prior to their deal announcements. In a normal environment, takeover announcements usually send shares of the acquired company to fresh 52-week highs, but because valuations have been beaten down so badly—down 24.5% on the S&P 500 through mid-October—this year has been the exception.

Additionally, these companies have a more transparent record of operating results, which in theory should make them more bankable for lending purposes.

Final Thoughts

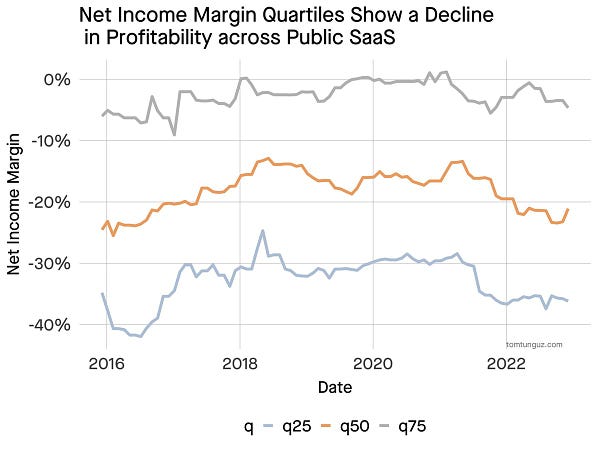

Investors across the board seem to be bullish on the take-private strategy for 2023. In his recent 2023 predictions post, Tomasz Tunguz (Ex- Redpoint MD), expressed his confidence in the strategy when it relates to software acquisitions:

Private equity acquires 10% of the 70+ publicly traded software companies by the end of the year. With hundreds of billions of dry powder, plenty of healthy cash flows generated by SaaS publics, & the leverage of the inevitable shareholder lawsuit if a board rebuffs the 30% premium of a tender offer, private equity becomes the dominant M&A option in dollar terms for 2023.

What We’re Reading and Listening To…

📚 Growth at all costs is no longer being rewarded

📚 A List of SaaS Benchmark Reports & Potential Dangers

📚 Vertical Acquisition Strategies

Favorites from the Ecosystem

Investors👇…..

Founders👇….

Operators👇….

News from the Industry: deals, deals, and more deals 💰

BC Partners considers selling a stake in compliance software firm Navex-sources

Vista Equity Partners acquires KnowBe4 in $4.6bn deal

WorkJam Gets $50 Million Growth Investment

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.