Take-Private's Are Off to a Hot Start in 2023

News, insights and updates from the team at Bloom Equity Partners

Happy Friday Folks!

We hope that you all enjoyed last week’s private equity predictions newsletter.

If you are a new reader, welcome 👋 to The Weekly Bloom. Every Friday, we share our favorite SaaS articles, podcasts, tweets, and news headlines from across the industry to now ~4,500 readers.

To start things off, Bloom is actively looking to deploy capital in opportunities that fit within our investment focus. Here’s a quick primer on what we look for:

What We Look For

We're big fans of mission-critical technology and software businesses with a competitive moat and a sticky and diversified customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure.

Investment Criteria

Industry: Enterprise Software and Tech-Enabled Services

Geography: North America, Europe, or Australasia

Revenue: $3M - $20M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% annual customer retention

Profitability: Positive EBITDA or near breakeven within 12 months

Investment Type: Operational control required

Business Characteristics

Significant recurring revenue

Sustainable competitive advantage with high switching cost

No heavy mandatory R&D spend, with a repeatable and scalable S&M process

Strong organic and inorganic growth potential

Capital efficient

Strong management team

If you or someone you know is considering selling or taking investment, we might be able to help out. We also just launched our referral partner program! If you want to be compensated for sharing business leads make sure to join.

Reply to this thread and we can get acquainted!

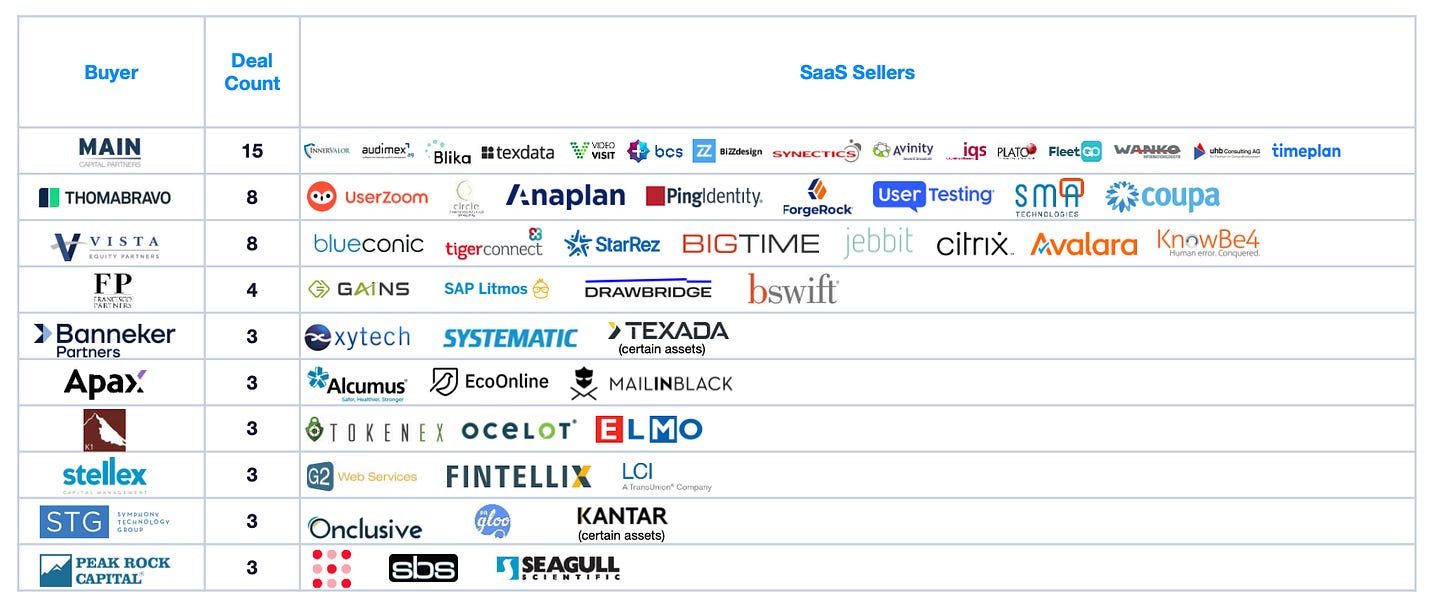

2022: Most Active Software PE Investors in SaaS

Deals From Across the Industry

Earlier this week, Canadian software company Magnetic Forensics entered into a definitive agreement to be acquired by Thoma Bravo. The company currently trades on the TSX, and Thoma Bravo has agreed to pay $44.25 per share, a more than 15 percent premium to Magnet’s January 19 closing price.

This is yet another example of the rise in take-privates that’s expected to trend into 2023. Given the dislocation in the public markets coupled with the ~$1.4 trillion in private equity dry powder waiting to be deployed, it appears unlikely that take-private transactions will slow down any time soon.

Of the 75 public-to-private acquisitions announced in 2022, PE firms paid an average discount of 6.7% to the target’s 52-week share price high. This is worth noting given that these stocks typically rose by 20% to 30% from their unaffected share prices prior to their deal announcements.

It’s worth noting that Thoma Bravo announced 9 take-privates in 2022, including Anaplan, Bottomline, Sailpoint, and Ping Identity.

We highlighted this trend in a recent newsletter:

Other notable deals:

What We’re Reading and Listening To…

📚 Permanent Equity 2022 Annual Letter

Favorites from the Ecosystem

Investors👇…..

Operators👇….

End Note 🔚

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a friend or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.