“Tech” in Private Portfolios is Mostly Software — A Sign of Resiliency

News, insights and updates from the team at Bloom Equity Partners

Happy Friday Folks,

Welcome back to another edition of The Weekly Bloom - a must-read for investors, operators, and founders navigating the world of software private equity. We hope that you enjoyed last week’s newsletter on The North Star Efficiency Metric.

This week, we’ll be looking at:

A Decade of Global PE Take Privates

Bain’s 2023 Private Equity Report

Bloom Equity Partners Career Opportunities

What We’re Reading and Listening To

If you want to join ~4800 other readers, tune in for a weekly roundup from our team, make sure to subscribe below:

Chart of the Week: A Decade of Global PE Take Privates

“Tech” in Private Portfolios is Mostly Software — A Sign of Resiliency

According to the recent Bain PE Report- “A full 88% of the technology investments in buyout funds are software”- which is significantly less volatile than public tech companies. These software bets tend to be mature SaaS enterprise businesses with stable cash flows, and a ‘sticky customer base’.

A few other interesting data points from the report:

Over the past decade, buyout funds have exited assets at valuations exceeding their last quarterly mark nearly 70% of the time.

While the S&P 500 closed 2022 down 19% and the MSCI Europe Index finished the year with a 17% decline, valuations for the private equity holdings of the largest public alternative asset managers—Blackstone, KKR, Apollo, and Carlyle—all held up better.

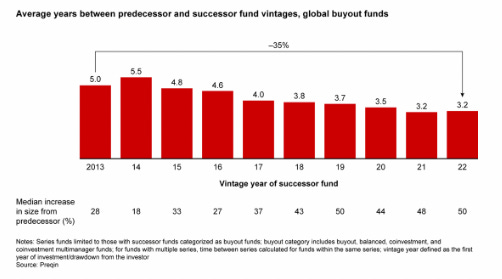

For buyout funds, the average period between successive funds has dropped 35% over the last decade as GPs circle back every three years instead of five.

If you enjoyed this breakdown make sure to check out the full Report👇

Private Equity Outlook in 2023: Anatomy of a Slowdown

Partner with Bloom Equity Partners

We're big fans of mission-critical IT services and software businesses with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure.

Our Investment Criteria

Industry: Enterprise Software and Tech-Enabled Services

Geography: North America, Europe, or Australasia

Revenue: $3M - $20M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% annual customer retention

Profitability: Positive EBITDA or near breakeven within 12 months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment, we might be able to help out. We also just launched our referral partner program! If you want to be compensated for sharing business leads make sure to join.

Reply to this thread and we can get acquainted!

What We’re Reading and Listening To…

Why Greatness Comes From the Bottom of the Bucket

Are professional CEOs really any better than founder CEOs?

Deals From Across The Industry

Silver Lake and Canadian pension fund bid $12bn for Qualtrics

Luminate buys manufacturing software maker

PSG Targets $6.5B for Next Growth Flagship Fund

Bloom Equity Partners Career Opportunities

Investing from our debut Fund, we’re actively hiring across several investment and operations roles, linked below. Reach out to careers@bloomequitypartners.com or on the specific job ad if you'd like to learn more / recommend someone for a role.

Favorites from the Ecosystem

Investors….

Operators….

Finders Program

Bloom Equity referral partners are our boots-on-the-ground referral network helping us scope out mission-critical, vertical SaaS businesses with $3M+ in revenue who are looking for their next phase of growth.

If you know of or run a business that may be a good fit for us, submit your lead and we’ll get back to you shortly:

End Note

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a colleague or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.