The North Star Efficiency Metric

News, insights and updates from the team at Bloom Equity Partners

Happy Friday Folks,

Welcome back to another edition of The Weekly Bloom - a must-read for investors, operators, and founders navigating the world of software private equity. We hope that you enjoyed last week’s newsletter on LP Allocations Remaining Strong in PE.

This week, we’ll be looking at:

APE: the efficiency metric of choice for software operators

2022 PE fundraising activity

Open roles at Bloom Equity Partners

Insights from across the industry

If you want to join ~4800 other readers, tune in for a weekly roundup from our team, make sure to subscribe below:

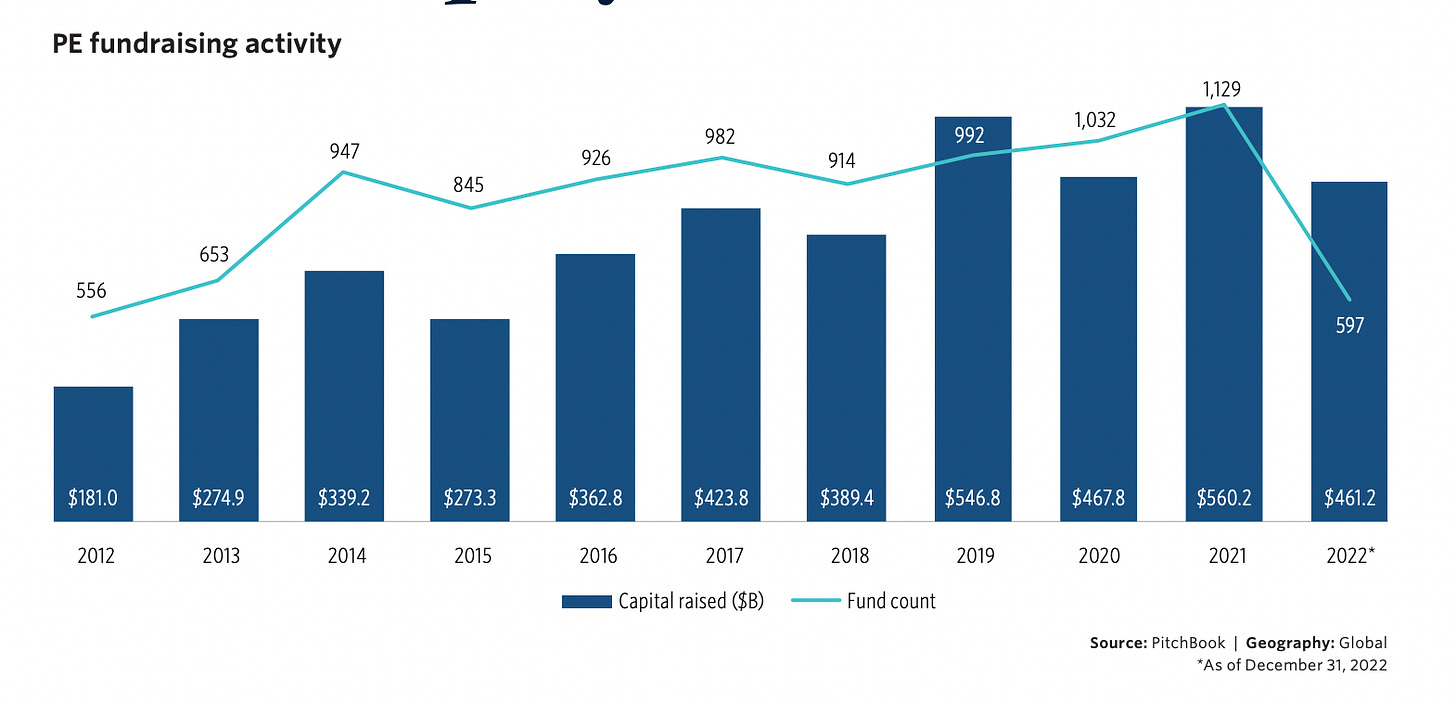

Chart of the Week: 2022 PE Fundraising Activity

ARR Per Employee (APE): SaaS Efficiency Metric to Help Navigate Market Downturns

As importance has been placed on profitability versus growth in today's high-rate environment, software operators have begun to focus on different efficiency metrics to navigate the market downturn (burn multiples, CAC payback period, LTV/CAC). There is no shortage of efficiency metrics to track but the issue lies in the fact that most aren't tangible for employees across an organization.

Burn multiple puts the emphasis on having “less bad burn” vs. being instructive on what actions will actually drive profitability.

In a blog post, the team at Battery Ventures shared their two cents on the topic and why ‘ARR per employee’ should be software executives’ north star for the foreseeable future.

Why Measure APE?

The cost structure of a SaaS company is primarily driven by headcount (60-70%+), with other costs such as cloud expenses and real estate expenses being less impactful. Therefore, the north star metric for efficiency should be driving as much value per employee.

Optimizing your employee base should ideally come through smart, measured hiring, not a reactive RIF (reduction in force). Achieving the former will help your business avoid the latter. When attempting to instill this hiring discipline across your organization, the APE north star can be a powerful tool.

It’s also a very tangible efficiency metric to measure as all business decisions (hiring, new projects, R&D) can be linked back to APE.

Benchmarks

Although there is not one magic number to benchmark for APE- the size, maturity, and location of a software business will all have an impact on the metric. The report highlighted APE ranges by ARR scale:

Getting to a higher APE earlier in the maturity cycle is likely a net positive. Overall, we believe having an aspirational goal of getting to $200K would serve most mid-stage/late-stage growth companies well.

Caveats for APE:

The specific vertical and nature of the market; A highly competitive horizontal product-market space versus a niche, vertical software market where there are limited competitive pressures will impact how executives approach APE.

If you want to dive deeper into the topic of APE you can read the full Battery Ventures report: here

Partner with Bloom Equity Partners

We're big fans of mission-critical IT services and software businesses with a competitive moat and a loyal, diversified, and growing customer base. Whether the business is bootstrapped, VC-backed, or a division of a larger organization, Bloom is completely agnostic to the structure.

Our Investment Criteria

Industry: Enterprise Software and Tech-Enabled Services

Geography: North America, Europe, or Australasia

Revenue: $3M - $20M (>70% recurring)

Growth: 5%+ annual revenue growth

Retention: >80% annual customer retention

Profitability: Positive EBITDA or near breakeven within 12 months

Investment Type: Operational control required

If you or someone you know is considering selling or taking investment, we might be able to help out. We also just launched our referral partner program! If you want to be compensated for sharing business leads make sure to join.

Reply to this thread and we can get acquainted!

What We’re Reading and Listening To…

Top Private Equity SaaS Investors

Don't get IPObliterated: Preparing for the SaaS IPO window inflection

SaaSletter - R&D Engineering -> Financial Engineering

Deals From Across The Industry

Events software vendor Cvent rebuffs $3.9 bln Blackstone bid-sources

Potentia hikes bid for Australia's Nitro Software to $364 mln

Private-Equity Firms Snap Up Data Centers as Cloud Demand Soars

Bloom Equity Partners Career Opportunity

Investing from our debut Fund, we’re actively hiring across several investment and operations roles, linked below. Reach out to careers@bloomequitypartners.com or on the specific job ad if you'd like to learn more / recommend someone for a role.

Favorites from the Ecosystem

Investors….

Operators….

Finders Program

Bloom Equity referral partners are our boots-on-the-ground referral network helping us scope out mission-critical, vertical SaaS businesses with $3M+ in revenue who are looking for their next phase of growth.

If you know of or run a business that may be a good fit for us, submit your lead and we’ll get back to you shortly:

End Note

As always, if you're enjoying The Weekly Bloom, we'd love it if you shared it with a colleague or two. We try to make it one of the best emails you get each week, and I hope you're enjoying it.

And should you come across anything interesting this week, send it our way! We love finding new things to read through members of this newsletter.

Revenue per employee cuts through all the noise. Prob my favorite metric. I actually made up a derivative of it - growth adjusted gross margin per employee

https://www.mostlymetrics.com/p/mostly-made-up-growth-adjusted-gross